7 June 2022

EU sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out early this year. How did the fundamentals develop and what are the expectations after the sowing 2022 has finished?

However, the world has changed dramatically since last report. Besides the Corona pandemic, which has been influencing global supply chains for more than 2.5 years, a war ravaged on the European continent since 24th February 2022. Agricultural and logistics markets are stressed and disrupted. A not excluded stop of gas supply during next campaign from Russia to Europe might result in some sugar beet factories not being able to process beets. Nordzucker is taking precautions. Processing of all beets and securing the sugar demand of our customer base is a priority for the next campaign. Where technically possible, we are switching factories to energy generation from oil, coal, or liquefied gas. The procurement of alternative energies incl. double sourcing strategies is in full swing. Also, longer campaigns and beet disposition might be necessary. Import of raw cane sugar and processing in Kantvik and Chelmza is another option.

Beet sowing was on average completed earlier than usual this year and despite frost nights replanting has been conducted to a lesser extent than last year. The weather has so far been relatively favorable across the continent, but rain is needed soon to create optimal conditions. In the latest MARS report, the EU Commission put out the first estimate of beet yield and for now they are using a figure that is 5.3% higher than the 5-year average due to the early sowing and favorable weather conditions.

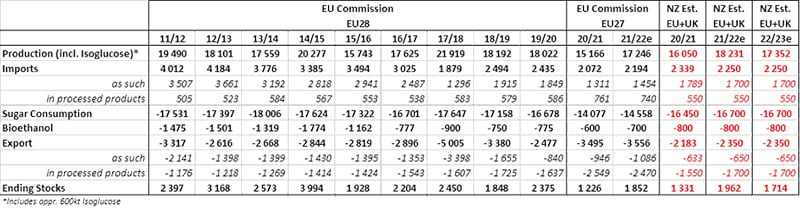

A takeaway out of the EU’s Management Committee for sugar 2nd June 2022 is the first estimation of the Beet areas 2022/23: down overall by 3.4% compared to current marketing year at 1.352 Mio ha. Main decreases in Poland (-25,400 ha) and France (-8,100 ha). COM will publish a first production estimate for 2022/23 soon. By applying the above-mentioned average yield approach to the estimated acreage, we may see a further drop of sugar production by some 500 kto in comparison to SMY 21/22. The EU sugar balance sheet has been adjusted, ending stocks described are somehow higher than in previous statistics but data quality still questionable.

Given the tight supply/demand balance, which is expected to continue into next year, higher and imports than earlier anticipated are needed to balance the market. Year-to-date volumes do however remain at roughly the same level as last year. It seems like refiners have been taking a wait-and-see approach given the uncertainties regarding energy prices and gas supplies.

Other takeaways:

• EU white sugar price for April 2022 at €446/t. Up from €443/t for March 2022. Spot prices in the meantime reached levels (partly) well above 800 €/to DAP across Europe

• Imports remain subdued: only 14kt of €98/t CXL sugar has entered the EU so far this marketing year; and under 300kt from the EPA/EBA countries.

Following the EU Parliament’s vote on 19 May, the Council has adopted a regulation on temporary (12 months) full trade liberalization for Ukrainian goods, including sugar, which will enter into force once it is signed and published in the Official Journal.