8 February 2022

EU sugar market update

In this article, we will look into developments in the European sugar market since our latest newsletter sent out end of last year. How did the fundamentals develop and what are the expectations after the campaign 2021 has almost finished?

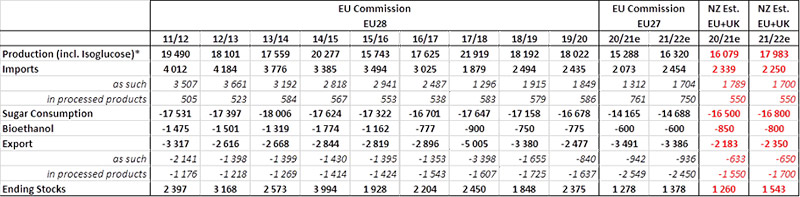

The beet harvest is coming to an end with only few countries still operating in February. Overall, the harvest has been better than feared in the beginning of the year when poor weather caused delayed sowing and, in some cases, re-sowing was needed. The good rains in the middle of the summer did not help the outlook, but conditions improved gradually to reach almost perfect conditions in the autumn. The result is a sugar yield on average across the EU at a level just above the long-term average resulting in a sugar production between 17.3 and 17.4 million according to our latest estimations (some 600 kto Isoglucose to be added to mirror the EU Commission number in below overview).

Latest trade data show, as expected, that export volumes in the first two months of the sugar marketing year 2021/22 are down year-on-year, while import is up. Trade activity in the full 2021/22 season is expected at roughly the same levels as last year: 1.7 mill. Mt of imports and 650kt of export.

Nordzucker shares the view of the European Commission, that demand for sugar will increase this season in comparison to last year, which obviously is due to lower severity of the Covid19 Omicron variant and an optimistic outlook into the spring / summer season and an increase out-of-home consumption. Currently the domestic markets continue to be quiet, and most of the regular buyers did already cover their demand. However, there are still few spot buyers left and they need to pay sugar basically based on import parity, which typically has (despite the recent No11 price correction) a cost value of 520 – 620 €/to EXW refinery / European port (depending on preferential or CXL status).

While the German authorities confirmed the ban of neonics also for the coming crop, The French Ministry of Agriculture has confirmed it will allow the use of neonic pesticides for beet production also in 2022. However, the restrictions on the crop rotation on the fields where beets were treated with neonics will remain like last year. There are countries acting like France and others confirming the ban, so a perfect rag rug across our continent as it is with the “VCS payments”.

Another specific uncertainty is still the acreage under sugar beets for the campaign 22/23. At this stage, Beet contracting volumes for next season have not reached levels producers wish for as farmers see attractive levels for competing crops and are stressed with significantly increasing input costs. Development in negotiations in the next couple of weeks will be determining for final beet areas. Currently we see a downside risk here, best case would be an area almost unchanged to the just finished season.