8 February 2023

EU Sugar Market Update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during November 2022. How did the fundamentals develop and what is the preliminary outcome after the campaign 2022 has almost finished across the continent?

The outlook on sugar production this season has been further revised down. We already gave in our November edition a detailed overview on the combined negative effect of reduced Beet area and the summer draught by some 1.5 million tons year-on-year of beet sugar production in the EU27/UK. The tail end of the campaign, however, has turned out worse than expected due to the frost that hit large part of the continent in December.

The low temperatures of up to -15 °C in the run-up to Christmas meant that the outer beet in the windrows at the edge of the field were frozen. This is not a problem at first, but temperatures of up to +15 °C around New Year’s Eve caused the beets to thaw again and become “altered”, a process in which bacteria in the beets form slimy substances. The processability is significantly reduced as a result. The consistency of such beets is like that of bananas or pears that come from the freezer. If beet is processed in this condition, the production output of the factories is reduced, as the filters for the lime from the juice purification clog due to the bacterial slime. Some factories had to stop prematurely. Others continued at reduced capacity to process the remaining beet volume. For beet that can no longer be processed, another use is sought, such as delivery to biogas plants.

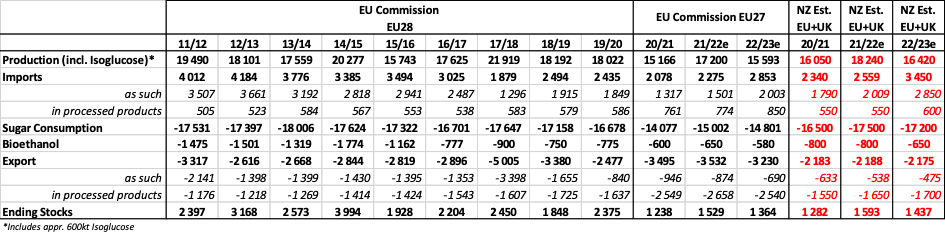

Producers are still assessing the final damage and so far, only one producer have publicly revised their production estimates while others may follow suit. Overall, we have lowered our EU27/UK production estimate to below 15.9 million tons (plus some 500 kto Isoglucose) with a downside risk.

European Sugar Balance as per EU Commission / Nordzucker own data:

By 6th February, Nordzucker has successfully completed its sugar production from sugar beet and sugar cane at all its factories in the seven European countries and in Australia. Yields are behind the 5-year average due to heat and drought in some regions. This was not compensated by higher sugar contents, so that the overall campaign result in Europe was below average. In contrary, the sugar cane harvest at our sites in Australia brought very good yields. We have ramped-up our sourcing activities for raw cane sugar to compensate the losses in beet sugar caused by this extreme growing and processing campaign. Our refineries in Finland and Poland are ready to receive and process the raw cane sugar, which is needed to serve the market and to fulfill the customer demand. Reliability for our customers, with whom we generally have long-standing and stable relationships, is our top priority.

A ruling by the European Court of Justice have put an end to temporary exemptions for banned neonicotinoid pesticides. In response French authorities have dropped the last of three years of planned use while others may continue for another year. The ruling is a hard blow to the European sugar industry as it will make it inherently difficult to attract short-term acreage due to the high risks involved on farm level. In a worst-case scenario European beet acreage will not grow from this year low levels, putting the European sugar balance in a permanently structural deficit.