8 November 2022

EU sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during June this year. How did the fundamentals develop and what are the expectations after the campaign 2022 has started?

The outlook on sugar production this season has significantly been revised down. After initially good signals with beet yields projected well above the 5-year average driven by an early beet sowing and relatively favorable weather across the continent, situation over summer has changed. The summer draught (resulting in low beet yields with high sugar content) in combination with heavy rains in September (diluting the sugar content and triggering beets to build new leaves while consuming sugar) has resulted in a correction down to 4% below the 5-year average. Together with a further reduction on the Beet area by some 4.5% in comparison to 2021 we are for now viewing a production of 16.2 million tons of beet sugar in the EU27/UK (to be added are some 500 kto of Isoglucose production expected this season). Consequently, a substantial increase in imports must offset this almost 1.5 million ton decrease in production.

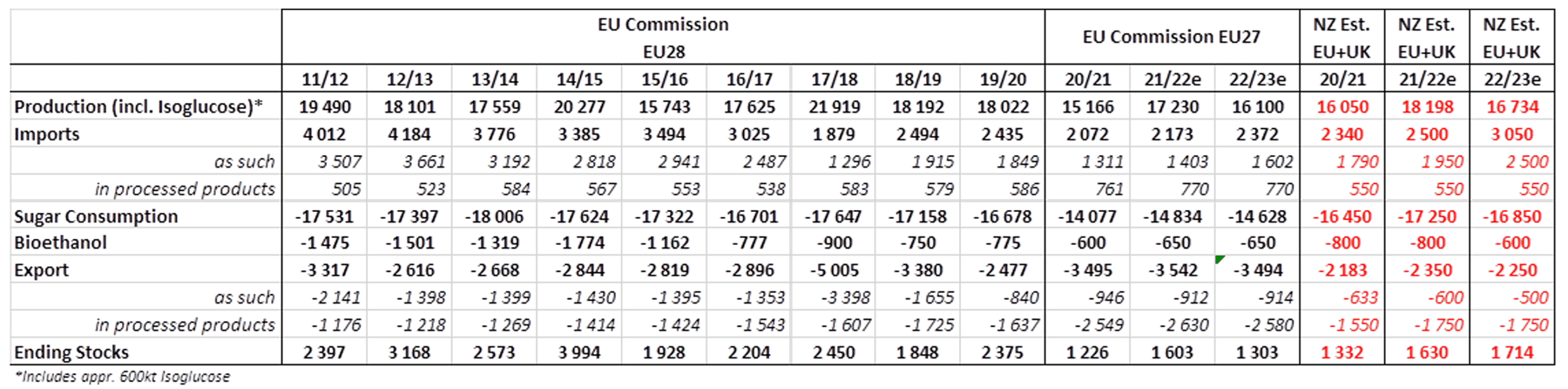

European Sugar Balance as per EU Commission / Nordzucker own data:

The first application round for CXL erga omnes import licenses valid for sugar market year 2022/23, under which the license holder can import raw sugar with an import duty of 98 €/to, was – not as a surprise – over-subscribed by the factor of 3.5, which reflects the tight EU market and low availability of sugar from preferential origins. We currently estimate imports to reach approximately 2.5 million tons and part of that need to be imported at an even higher price than the above mentioned CXL erga omnes volumes.

The strong demand over the last summer has left the market with ending stocks that are worryingly low. As we maintain for the time being our view of a fairly robust consumption also for the upcoming season, we expect the situation despite higher imports to remain tight for at least another 12 months.

The campaign at Nordzucker is now in full swing in all countries. The start-up phase did not always go smoothly this year following the needed conversion to other energy sources coupled with challenges in getting processing aids in-time. However, after a short time, all the factories were at their performance levels. In parallel our refineries are now ready to receive and process the raw cane sugar, which is needed to serve the market. Reliability for our customers, with whom we generally have long-standing and stable relationships, is our top priority.