7 February 2024

EU market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out. How did the fundamentals develop and what are the expectations after the beet sugar production campaign 2023 is coming to an end?

Continuous rain, floods, flooded fields and roads, frost, limited harvesting and logistics, time-consuming processing in the factories – the current beet sugar campaign across Europe is certainly a challenge. The campaign has been prolonged further in several countries as damaged beets affect processing capacity of the plants negatively. It’s becoming factual that not all beets will be harvested. Consequently, we have lowered our production estimate for the full campaign again by another 250 kto towards 16.3 million tons.

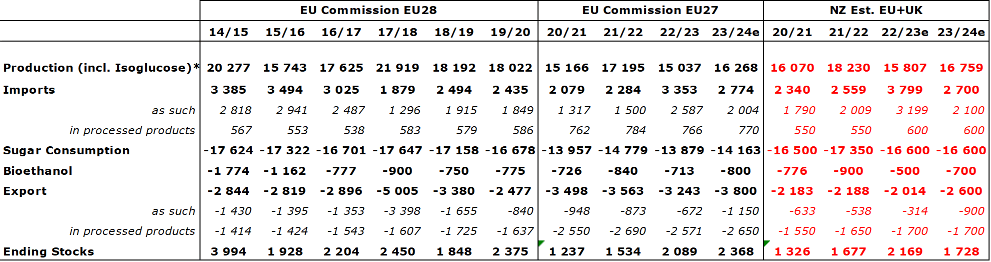

European Sugar Balance as per EU Commission / Nordzucker own data:

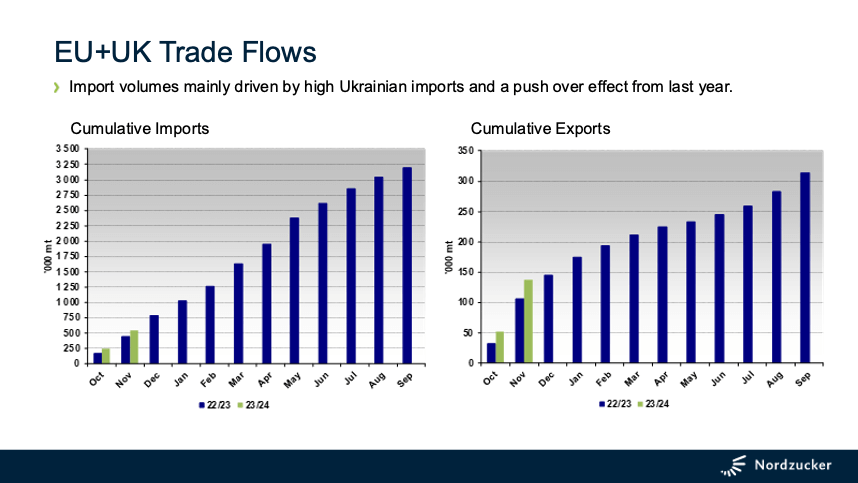

October and November witnessed both higher imports and exports compared to the previous year. The pace of exports was however lower than earlier anticipated and hence we have reduced our estimate for the full year. The net result of lower production as well as import and export are lower availability and hence lower estimated ending stock than previously anticipated.

At the time of writing, protests by farmers across the EU are steadily increasing against the uncontrolled and distorting inflow of agricultural products from Ukraine. Consequently, the Commission has proposed now to renew the suspension of import duties and quotas on Ukrainian exports to the EU for another year, while reinforcing protection for sensitive EU agricultural products including sugar. An emergency brake is foreseen which would stabilize imports at the average import volumes in 2022 and 2023. This may translate to approximately 320 kto for 2024 and 145 kto for Jan-May 2025, both figures including the possibly revived TRQ of 20,070 tons as an addition in case the volume has been reached before end 2024, resp. before 5th June 2025. Given the imports in Oct-Jan, Ukrainian imports in SMY 23/24 could still reach 500kt.