9 November 2023

EU market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during February this year. How did the fundamentals develop and what are the expectations after the beet sugar production campaign 2023 has started?

The campaign has reached full speed across the EU and there are mixed messages regarding the status of the beets. Beet yields continue to improve but sugar content has not caught up. The outlook on sugar production this season has been revised slightly up, however not as much as one could have hoped for after the warm and dry September. The latest MARS report increased its EU beet yield forecast for the current season from the projected 74.5mt/ha in September to 74.7mt/ha. In contradiction, the sugar content remains across the continent below the long-term average. Furthermore, cases of Macrophomina, which causes beets to rot, have been reported in Central Europe. We hear also of SBR (Syndrome Basses Richesses) and Stolbuhr, both diseases causing losses in sugar yield. The magnitude of the problem is still unknown but will for sure be followed closely by market participants.

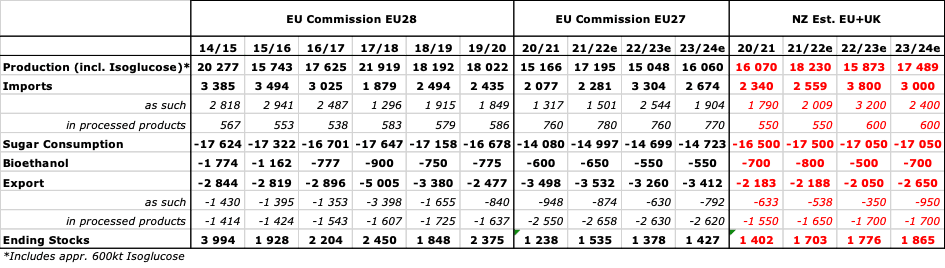

Together with an increase of the Beet area by some 4% in comparison to 2022 we are for now viewing a production of up to 16.9 million tons of beet sugar in the EU27/UK (to be added are some 500 kto of Isoglucose production expected this season). As a recap this would still be 700 kto lower than the beet sugar production two years ago and will consequently result in a substantial decrease of the import need and to a certain recovery of the stressed stock situation.

European Sugar Balance as per EU Commission / Nordzucker own data:

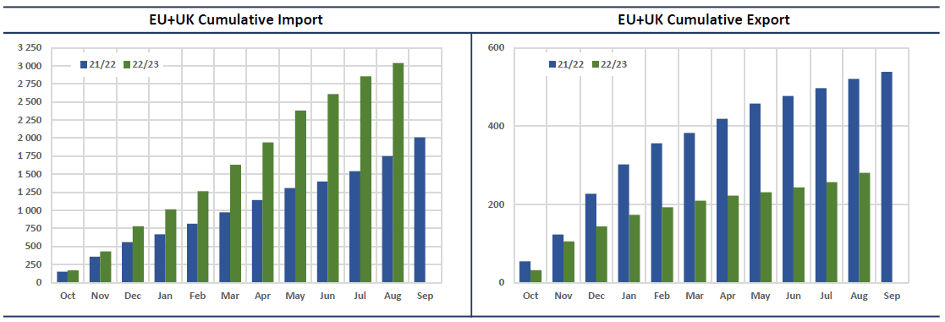

Latest available trade data shows that imports already slowed down in August as expected. Until end August more than 3 million tons of sugar had been imported to the EU+UK while only 280 kto had been exported. For 2023/24 we expect imports to reach 2.4 million tons in 2023/24 and export to reach 950 kto. Imports from Ukraine have started again and are widely expected to reach up to 700 kto this sugar marketing year. Worth noting is also that the first application round for CXL erga omnes import licenses valid for sugar market year 2023/24, under which the license holder can import raw sugar with an import duty of 98 €/to, was fully subscribed to.

We are sticking to our estimates of a slight decrease in total demand for the year. A change in consumer behavior, due to the economic uncertainty, might have a negative effect on total sugar demand for the year.