10 November 2025

EU sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during June this year. How did the fundamentals develop and what are the expectations after the beet sugar production campaign 2025 has started?

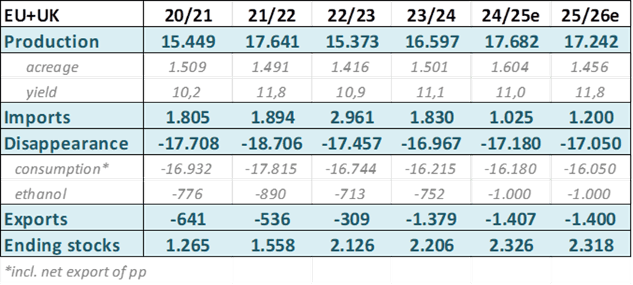

In Europe, early sowings in combination with finally mild temperatures and adequate rainfall in central and northern Europe contributed to a robust crop development. The main change during recent months came from France, where beets recovered surprisingly well from early summer stress. This led the French Agricultural Ministry to revise their yield expectations higher, now showing an increase of +9% from last year’s beet yields. In Germany, despite pest-related damage in the southern regions, good yields were reported elsewhere. In Southern Europe, summer drought and more recent excessive rainfall in some countries have disrupted crop developments, but sugar content appears to have been less affected than other crops. Overall, we have raised our production expectations for the campaign to 17.2 million tons, indicating a reduction of 3% in comparison to last year’s production while the acreage as per earlier projection has been reduced by more than 9%.

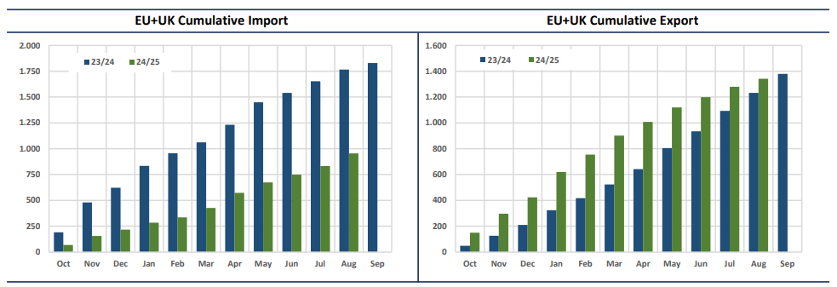

Higher exports and lower imports are the consequences. Latest trade data show indeed such developments bringing the cumulative figures (update by end of August) to some 955 thousand tons of Imports and already an Export volume of almost of 1.4 million tons respectively. Reported ending stocks in August are basically unchanged versus previous year.

Prices in Europe have been correcting since August this year on the back of the constantly revised production outlook. Given the good stock levels in the EU market driven by the better-than-expected results for the current crop, producers are starting to reduce beet price contracts for the coming year which will eventually result in a lower crop area in 2026 and further consolidation in the European production footprint. Our forecast projects an acreage decline of 4%, which would by assuming average yields result in a production drop of more than one million tons of sugar production.