10. Juni 2025

EU Sugar market update

In this article, we will investigate developments in the European sugar market since our latest newsletter sent out during February this year. How did the fundamentals develop and what are the expectations after the sowing 2025 has almost finished?

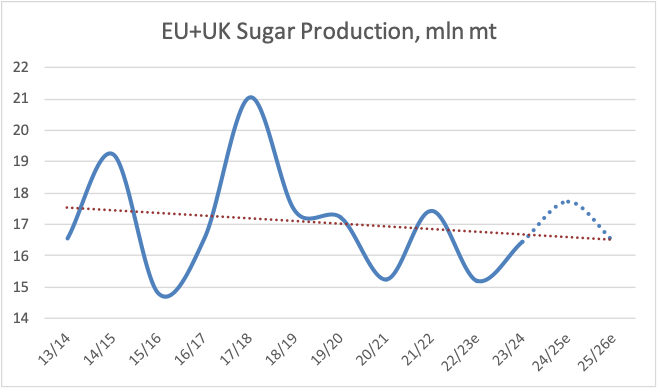

In an exceptionally long and productive campaign ending only in March 2025, Nordzucker produced around three million tons of sugar from beets under favorable production conditions, more than ever before. European-wide pre-final production figures have been around 17.8 million tons, which moved the market into a surplus situation. Going-forward, it can be observed that the area under beet cultivation will be reduced visibly this year. Market consensus is a reduction of 7-9% versus previous year. Nordzucker has also adjusted its beet contracts accordingly. The number of beet sugar factories will further shrink for the upcoming campaign across Europe. After recent announcements on closures in France, Austria and Hungary, lately Azucarera announced that it will stop processing sugar beet at the La Baneza plant in Leon and at the Miranda de Ebro plant in Burgos.

Sowing is now completed for the new season in all our countries. The period of drilling was quite okay. However, and according to the May MARS report, spring 2025 has been exceptionally dry in north-western Europe, with Benelux, northern France, Germany, western and southern Poland, and Sweden experiencing one of the driest springs on record. While cool nights and moderate daytime temperatures have helped limit crop stress so far, soil moisture levels are critically low, and rainfall is urgently needed to support yields. The warm, dry conditions have also favored the spread of yellow virus via aphids, particularly in France and the UK. As the important period for yields are still ahead of us, we keep our sugar yield numbers unchanged at the long-term averages for time being and with an estimated 8% decrease in acreage we end up with a production estimate at 16.6 million tons (EU/UK), down by 1.3 million tons year-on-year.

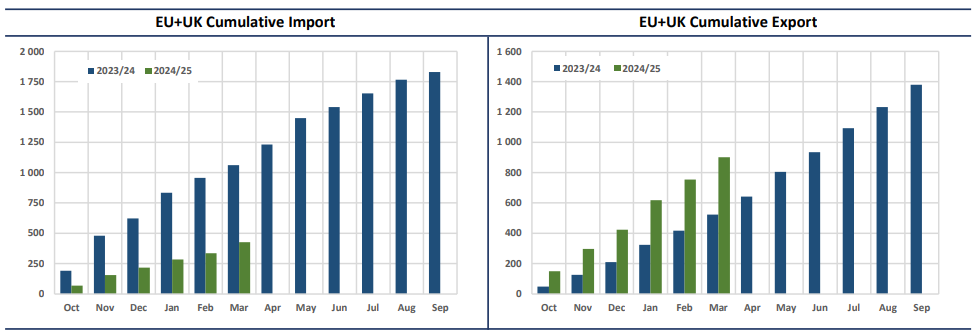

Reported ending stocks in March were virtually unchanged year-on-year, despite higher production, indicating very strong disappearance. With exports expected to potentially slowdown in the coming months, ending stocks are likely to finish slightly higher than last year—providing a buffer against the anticipated production decline.

On trade, significant changes are visible on the white sugar imports from neighboring countries. Balkan sugar is entering very slowly: only 17 kto of Serbian sugar in this marketing year (quota of 203 kto). With respects to imports from Ukraine, the EU Council has adopted the Commission’s Implementing Regulation granting Ukraine access to 7/12 of its annual sugar TRQ under the 2014 Association Agreement. This allows 11,708 mt of duty-free imports between 6 June and 31 December, in addition to the 109,439 mt already available under the ATM regime for the first half of 2025. As a recap, total imports from Ukraine have been 331,699 tonnes during 2024.